In a competitive market, especially within insurance, building trust with clients is key, particularly for single-owner businesses. Tailored solutions like affordable business insurance, liability coverage, and customized trucking/cargo protection demonstrate commitment to client security. By addressing unique needs, insurers gain confidence as trusted partners, fostering long-term relationships. Strategic planning through tailored insurance minimizes risks, allowing solo operators to focus on growth and service without financial worry.

Building trust with clients is paramount in fostering strong business relationships. In today’s competitive market, offering robust insurance coverage can set you apart and assure clients of your reliability. This article explores the critical role of comprehensive insurance in gaining client confidence, focusing on tailored solutions for single-owner businesses and independent operators. From liability coverage for small businesses to customized trucking insurance and cargo protection, discover how different policies fortify your business and protect valuable assets.

Understanding Your Clients' Needs: Unveiling the Importance of Trust in Business Relationships

In the competitive business landscape, fostering trust with clients is paramount, especially in the insurance sector. Understanding your clients’ unique needs is the cornerstone of this process. Many small businesses, particularly single-owner enterprises, seek tailored solutions for their operations. This often includes affordable business insurance that covers a range from general liability to specific sectors like trucking and cargo protection. By offering customized policies, such as physical damage protection for vehicles, insurers demonstrate a commitment to their clients’ well-being.

Building trust involves recognizing that each client has distinct requirements. For instance, solo operators may prioritize cost-effective coverage options while still ensuring comprehensive protection. This level of personalized service not only meets immediate insurance needs but also fosters long-term relationships. Clients who feel heard and understood are more likely to remain loyal and advocate for your services, creating a robust foundation for any business association.

The Role of Comprehensive Insurance Coverage in Building Client Confidence

Building trust with clients is a cornerstone of any successful business relationship, and comprehensive insurance coverage plays a pivotal role in this process, especially for solo operators and small businesses. By offering tailored insurance solutions, such as affordable business insurance, physical damage policies, and liability coverage for small businesses, you demonstrate a commitment to your clients’ well-being and financial security. This is particularly crucial for single-owner businesses, where the owner wears many hats, making them more vulnerable to risks associated with their operations.

When you provide customized trucking insurance or cargo protection for solo operators, you convey an understanding of their unique challenges and a desire to mitigate potential losses. Such robust coverage builds client confidence by showing that you have taken proactive steps to protect their interests. In today’s competitive market, where folks are often wary of hidden costs and unexpected events, this level of foresight and security can set you apart as a trusted partner rather than just another service provider.

Tailoring Insurance Solutions for Single-Owner Businesses and Independent Operators

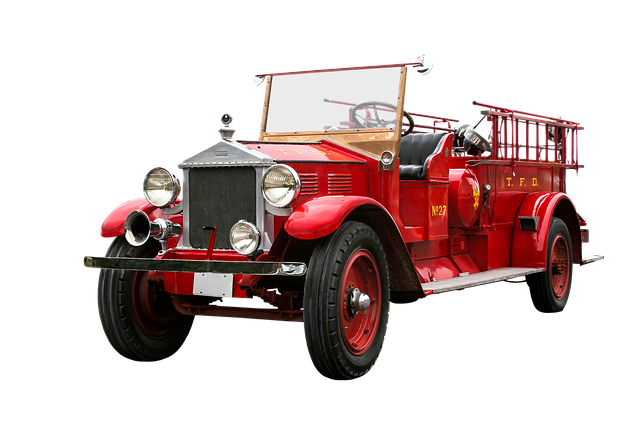

For single-owner businesses and independent operators, having the right insurance coverage is paramount to building trust with clients. These individuals often face unique challenges that require tailored insurance solutions. Traditional business insurance policies might not cater to their specific needs, such as affordable rates for low-volume operations or comprehensive liability coverage for high-risk activities. By offering customized trucking insurance and cargo protection options, insurers can demonstrate a commitment to understanding and mitigating these risks.

This personalized approach extends beyond mere product offerings. Insurance providers who actively engage with clients to assess their specific business activities and potential exposures build trust through transparency. Offering physical damage policies that cover equipment, vehicles, and premises ensures these independent operators that their investments are safeguarded. Ultimately, this level of customization and care signals a genuine partnership aimed at fostering long-term client relationships.

Protecting Assets, Minimizing Risks: How Different Types of Coverage Can Fortify Your Business

For single-owner businesses or independent operators, minimizing risks is key to long-term success and stability. One effective strategy is to invest in tailored insurance for their specific operations. Affordable business insurance packages that include liability coverage for small businesses can shield against financial loss due to accidents, injuries, or legal disputes. This protection is vital, as even a single incident could cripple a solo operation.

Trucking operators, for instance, should consider customized trucking insurance that includes cargo protection. Physical damage policies are also essential to safeguard assets and ensure business continuity in case of vehicle accidents or other unforeseen events. By selecting the right coverage options, businesses can fortify themselves against potential risks, allowing them to focus on growth, innovation, and serving their clients without constant worry about financial exposure.

Building trust with clients is paramount in fostering strong business relationships. By understanding their unique needs and offering robust insurance coverage, such as tailored solutions for single-owner businesses and affordable liability options for small firms, you demonstrate commitment to their success and protection. Comprehensive insurance, including customized trucking insurance, cargo protection, and physical damage policies, not only minimizes risks but also reinforces the reliability and reputation of your business, ensuring a solid foundation for lasting client partnerships.