Running a single-owner business comes with unique insurance challenges. Tailored insurance solutions are key to addressing specific risks like liability (especially crucial for small businesses), cargo protection (for solo operator trucking sectors) and physical damage. Affordable business insurance options enable cost-effective, comprehensive coverage for these diverse needs, balancing protection and overheads. By carefully evaluating their unique requirements, business owners can secure adequate insurance at reasonable rates, fostering growth and financial security.

Navigating the complexities of combining personal and commercial coverage can be a daunting task for single-owner businesses. This comprehensive guide explores the unique challenges faced by independent operators and offers tailored strategies for creating a customized insurance plan that meets their specific needs. We delve into affordable business insurance options, emphasizing the importance of balancing coverage and cost. Additionally, we dissect essential policies like comprehensive liability, cargo protection, and physical damage coverage to ensure assets are shielded.

Understanding Your Needs: Recognizing the Unique Challenges of Single-Owner Businesses

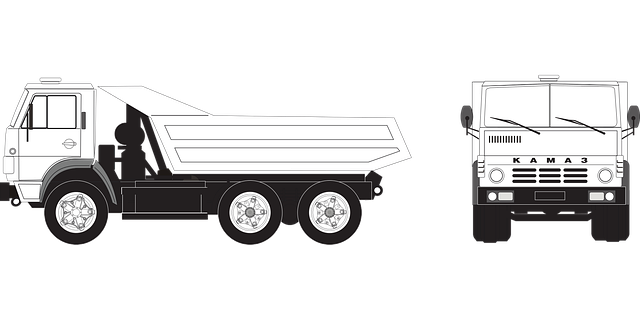

Running a single-owner business comes with its unique set of challenges when it comes to insurance. These entrepreneurs often juggle multiple roles, from operations manager to accountant and marketer, all while ensuring their business runs smoothly. Their specific needs for coverage may be different from larger enterprises, focusing on tailored insurance solutions that address the unique risks they face. For instance, solo operators in trucking or delivery sectors require customized trucking insurance that includes cargo protection, as they bear the financial brunt of any loss or damage during transit.

Liability coverage for small businesses is crucial to shield against unexpected claims related to bodily injury or property damage. Physical damage policies also play a vital role in protecting their investments, whether it’s their vehicle, equipment, or inventory. Given the affordable business insurance options available, single-owner businesses can find comprehensive yet cost-effective solutions tailored to their operations, ensuring they are prepared for any eventuality while keeping overheads manageable.

Tailoring Insurance for Independent Operators: Creating a Customized Plan

For independent operators, be it a sole proprietorship or a small fleet, navigating the insurance landscape can seem daunting. However, the key lies in tailoring insurance for their unique needs. This means going beyond off-the-shelf packages and crafting a customized plan that addresses specific risks associated with operating a business.

By focusing on areas like liability coverage for small businesses, cargo protection for solo operators, and physical damage policies, insurers can offer affordable business insurance that provides peace of mind. This approach ensures that the coverage aligns perfectly with the operations, leaving no gaps or overlaps, thereby offering optimal protection at a competitive price.

Exploring Affordable Business Insurance Options: Balancing Coverage and Cost

Many single-owner businesses and independent operators struggle to find a balance between adequate coverage and manageable costs when exploring business insurance options. Affordable business insurance is accessible, but it requires careful consideration. Customized trucking insurance, for instance, can offer essential cargo protection for solo operators, while physical damage policies safeguard assets from unforeseen events.

Liability coverage for small businesses is crucial to shield against potential legal issues. Tailored insurance plans cater specifically to the unique needs of these entities, ensuring they’re protected without exceeding their budget. By evaluating risks and selecting appropriate coverage, business owners can navigate the complexities of combining personal and commercial insurance, finding a suitable balance that supports both growth and financial security.

Protecting Your Assets: Comprehensive Liability, Cargo, and Physical Damage Policies Explained

In the world of single-owner businesses and independent operators, protecting your assets is paramount. Tailored insurance for these entities often revolves around comprehensive liability coverage, which shields against potential risks and claims related to business operations. This includes policies that address cargo protection for solo operators, ensuring the safety and security of goods during transit, a crucial aspect for those in the trucking industry.

Additionally, physical damage policies play a significant role in safeguarding your business’s tangible assets. Whether it’s equipment, vehicles, or real estate, these policies offer financial safeguards against unforeseen events like accidents, natural disasters, or vandalism. For affordable business insurance that caters to small businesses and customized trucking insurance, having the right combination of liability coverage and physical damage protection can make all the difference in navigating complex legal and financial landscapes.

Navigating the complexities of combining personal and commercial coverage is a crucial step for single-owner businesses aiming to protect their assets effectively. By understanding unique challenges, tailoring insurance plans to specific needs, and exploring affordable options that balance coverage and cost, independent operators can secure comprehensive liability, cargo, and physical damage protection. This ensures peace of mind, safeguarding both the business and personal aspects of a solo enterprise in an ever-changing market.