Single-owner operations require tailored insurance addressing unique risks like personal liability, cargo protection during transit, and physical damage to equipment. Affordable business insurance packages with comprehensive coverage, including liability coverage for small businesses and physical damage policies, safeguard assets and promote business continuity for these independent operators. Customized trucking insurance is crucial for cargo protection during transport. This proactive approach offers peace of mind, enabling operators to confidently navigate the uncertainties of their trade while managing costs effectively.

In today’s competitive landscape, single-owner operations face unique challenges that require specific attention. This article delves into the critical need for tailored insurance coverage designed to meet the distinct needs of independent operators. We explore essential aspects such as liability coverage for small businesses, affordable business insurance options, and customized trucking and cargo protection for solo operators, offering solutions that ensure comprehensive risk management. By understanding these challenges, business owners can navigate their operations with enhanced peace of mind and financial security.

Understanding the Unique Challenges of Single-Owner Operations

Single-owner operations face distinct challenges when it comes to insurance. Often, these businesses juggle multiple roles, from management to operations, leaving limited time for navigating complex insurance landscapes. They require coverage that is not only comprehensive but also affordable, tailored to their specific needs. While general business insurance policies may offer some protection, they often fail to address the unique risks faced by solo operators, such as personal liability, cargo protection during transit, and physical damage to equipment or vehicles.

These operations rely heavily on their assets, including their vehicle(s) and any specialized equipment, for daily functions and revenue generation. Therefore, customized trucking insurance policies that include adequate liability coverage and cargo protection are crucial. Additionally, single-owner businesses need physical damage policies that account for the potential risks of their work environment, whether it’s a home office or a mobile workspace. By tailoring insurance to these specific needs, independent operators can safeguard their assets, mitigate financial risks, and ensure continuity in their operations.

The Importance of Tailored Insurance Coverage for Independent Operators

For single-owner operations, having the right tailored insurance coverage is more than just a precaution; it’s a strategic necessity. These independent businesses often face unique risks that standard policies might not adequately address. By customizing their insurance to fit specific needs, operators can protect themselves from potential financial disasters and ensure their business’s longevity. For instance, a solo truck driver requires specialized trucking insurance that covers cargo protection, offering peace of mind during transit. Similarly, physical damage policies are crucial for safeguarding equipment and vehicles against accidents or natural calamities.

Beyond these, liability coverage for small businesses is essential to safeguard against claims related to property damage or personal injury. Affordable business insurance packages designed specifically for single-owner operations can offer comprehensive protection while keeping costs manageable. This proactive approach enables operators to navigate the uncertainties of their trade with confidence, knowing they have the right level and type of coverage tailored to their unique circumstances.

Affordable Business Insurance Options for Small Scale Businesses

For single-owner operations, finding affordable business insurance options that offer comprehensive coverage can be a game-changer. These small scale businesses often require tailored insurance plans to protect their unique risks and liabilities. Independent operators, whether they’re running a trucking operation or a local service business, need solutions that go beyond basic policies. Customized trucking insurance, for instance, ensures cargo protection for solo owners transporting goods, addressing a specific niche risk.

Liability coverage for small businesses is paramount, as it shields against potential claims and suits. Physical damage policies also play a crucial role in protecting assets, whether it’s a company vehicle or equipment. By combining these tailored insurance options, single-owner operations can gain peace of mind, knowing they’re equipped to handle unexpected events while keeping costs manageable.

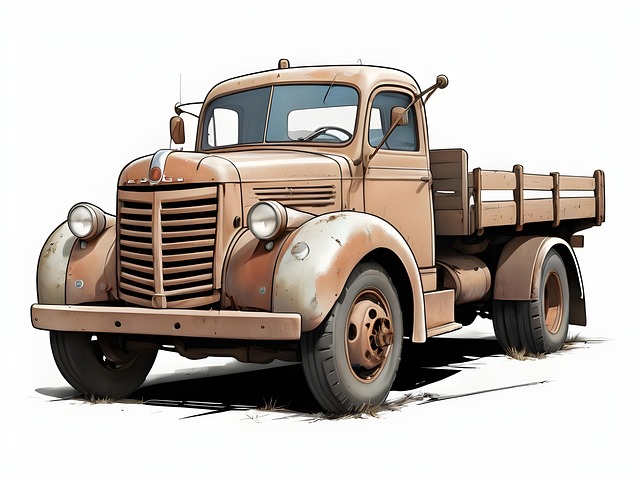

Customized Trucking and Cargo Protection for Solo Operators

Single-owner trucking operations often require specialized and customized insurance solutions to address unique risks associated with their industry. These independent operators, who shoulder multiple roles, need comprehensive coverage that protects not just their business but also their personal assets. Tailored insurance for such businesses focuses on providing affordable yet robust physical damage policies and liability coverage for small enterprises.

For instance, a customized trucking and cargo protection policy can safeguard solo operators against financial losses due to damages or theft of goods during transit. This specialized coverage goes beyond standard business insurance by offering specific protections tailored to the unpredictable nature of road transport. By availing such tailored insurance, single-owner operations can ensure their ongoing sustainability and peace of mind in an ever-changing industry landscape.

For single-owner operations, navigating the complexities of insurance can seem daunting, but understanding tailored solutions is key. By recognizing the unique challenges these businesses face, such as financial vulnerability and specific operational risks, independent operators can access affordable business insurance options. Customized trucking and cargo protection ensures their assets are secure, while liability coverage for small businesses mitigates potential legal issues. Embracing tailored insurance for independent operators allows them to focus on growth and success, knowing they have robust physical damage policies in place to safeguard their investments.